vermont sales tax on cars

Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. You can find these fees further down on the page.

Vermont Sales Tax Small Business Guide Truic

The statewide car sales tax in Vermont is 6.

/cloudfront-us-east-1.images.arcpublishing.com/gray/EZRABZD6HNBIJNH3N4NDMRLXP4.JPG)

. The base state sales tax rate in vermont is 6. You can find these fees further down on the page. Local option tax is a way for municipalities in Vermont to raise additional revenue.

The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

PA-1 Special Power of Attorney. Average Sales Tax With Local6182. Other local-level tax rates in the state of Vermont are quite.

This document provides sales and use tax guidance for auto supply dealers auto repair shops. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of. Vermont has a statewide sales tax rate of 6 which has been in place since 1969.

A municipality may vote to levy the following 1 local option taxes in. Customers who purchase new or used clean alternative fuel or hybrid vehicles may qualify for a sales and use tax exemption if the vehicle is delivered to them between August 1. W-4VT Employees Withholding Allowance Certificate.

Both dealers and repair shops must register with the Vermont Department of Taxes to collect. IN-111 Vermont Income Tax Return. You can find these fees further down on the.

The Vermont VT state sales tax rate is currently 6. The base state sales tax rate in vermont is 6. There are a total of 155 local tax.

A 1 There is hereby imposed upon the purchase in Vermont of a motor vehicle by a resident a tax at the time of such purchase payable as hereinafter provided. In addition to taxes car purchases in Vermont may be subject to other fees like registration title and plate fees. Depending on local municipalities the total tax rate can be as high as 7.

An example of items that are exempt from Vermont sales. Vermont collects a 6 state sales tax rate on the purchase of all vehicles. Vermont School District Codes.

Vermont Sales Tax Exemption Certificate for REGISTRABLE MOTOR VEHICLES OTHER THAN CARS AND TRUCKS where seller does not collect purchase and use tax. Learn about the regulations for paying taxes and titling motor vehicles. Maximum Possible Sales Tax.

Whether youre buying new or used youll pay the same amount of tax. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from. Whether youre buying new or used youll pay the same.

You can find these fees further down on the. Local Option Tax. Average Local State Sales Tax.

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Sales Taxes In The United States Wikipedia

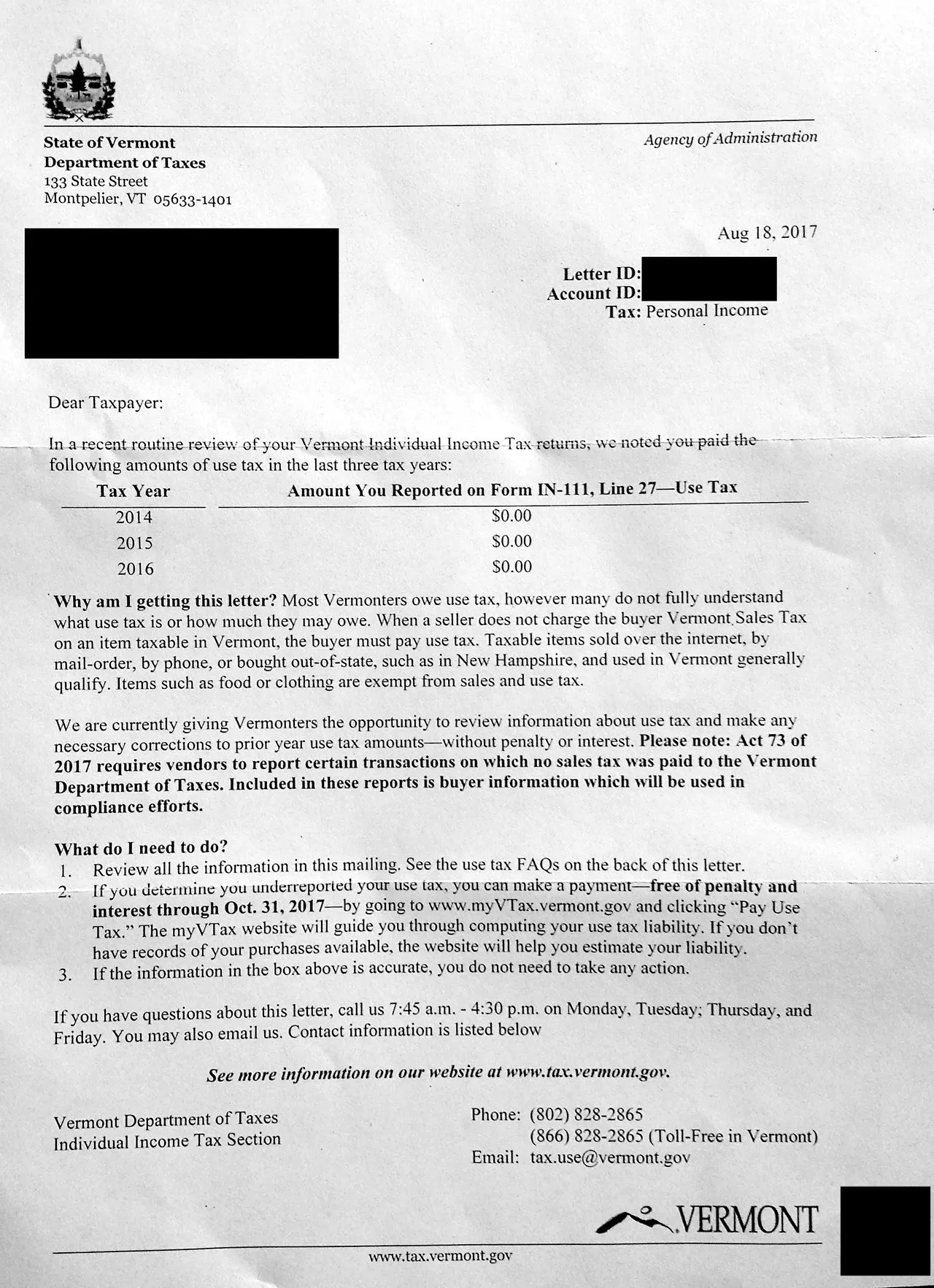

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

Car Tax By State Usa Manual Car Sales Tax Calculator

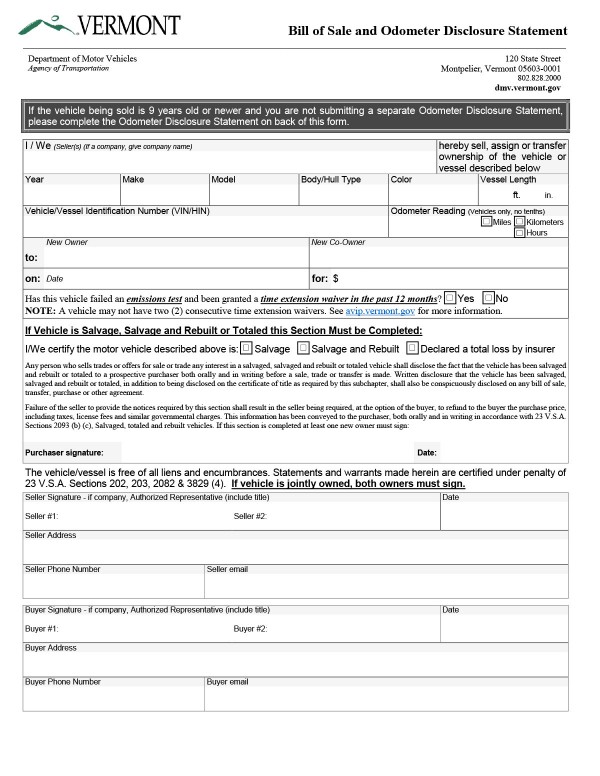

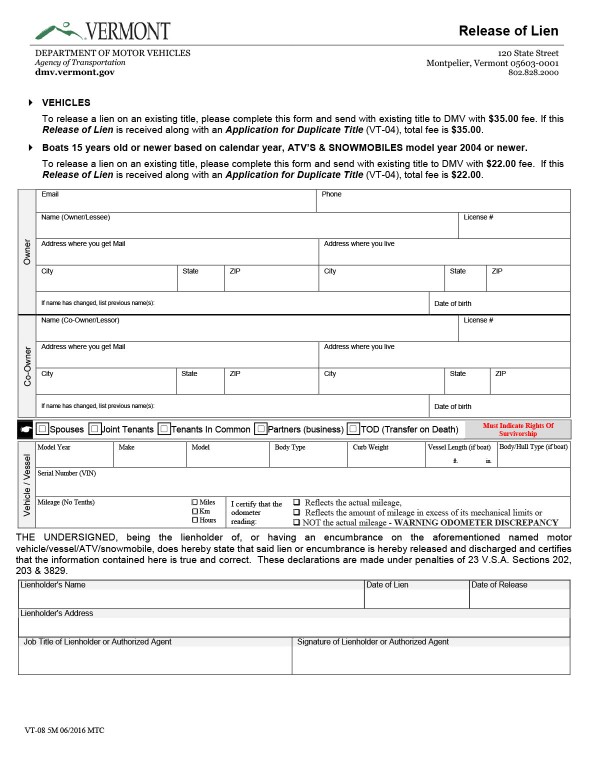

Paperwork Required When Buying A Car In Vermont Vinfreecheck

No Vt Sales Tax For Non Residents Buy A Subaru In Vermont At Brattleboro Subaru

Used Certified Vehicles For Sale In Saint Albans Vt Handy Buick Gmc Cadillac

About Bills Of Sale In Vermont Key Forms Information

Car Tax By State Usa Manual Car Sales Tax Calculator

Used Cars For Sale Near Burlington Handy Toyota St Albans

Used Car Truck Suv Dealership Formula Ford In Rutland Vt

Nj Car Sales Tax Everything You Need To Know

About Bills Of Sale In Vermont Key Forms Information

Used Cars For Sale In Barre Vt Cars Com

New Toyota Dealer Alderman S Toyota Vermont

Used Toyota Cars For Sale In Burlington Vt Cars Com

Springfield Vt Used Car Dealer Mcgee Chrysler Dodge Jeep Ram Fiat Of Springfield